This Week in SaaS - Jan 20 - 26, 2026

Top exits, deals, news, and blog posts of the week

💻 New App

This week we’re beta launching Pulse, an AI-curated technology news application just for our community members. Please create an account and follow SaasRise and Ryan Allis. We welcome your feedback on how to make the app even better before we launch widely next month. It’s the first application of its kind to curate and summarize tech news from traditional publishers as well as YouTube, LinkedIn, Threads, and blogs.

- SaaS Daily News & Funding Announcements

- AI Daily News & Funding Announcements

- B2B Growth Daily News & Funding Announcements

📚 New Blog Posts & Videos

- How I Built My SaaS Company to $50m/year and Sold it For $169m (step by step) 🎥

- What’s Actually Working in B2B SaaS Marketing in 2026

- The AI Coding Revolution: How Claude and AI Assistants Are Transforming Software Development in 2026

- AI Coding & AI Design in 2026

- How to Implement EOS in SaaS

- How to Make Your Brand Omnipresent with Digital Ads

- How to Set up LinkedIn Thought Leader Ads

- How to Set up Paid Search on Google and Bing

- CEO Mastermind Recaps for the Week of Jan 19 - 22, 2026

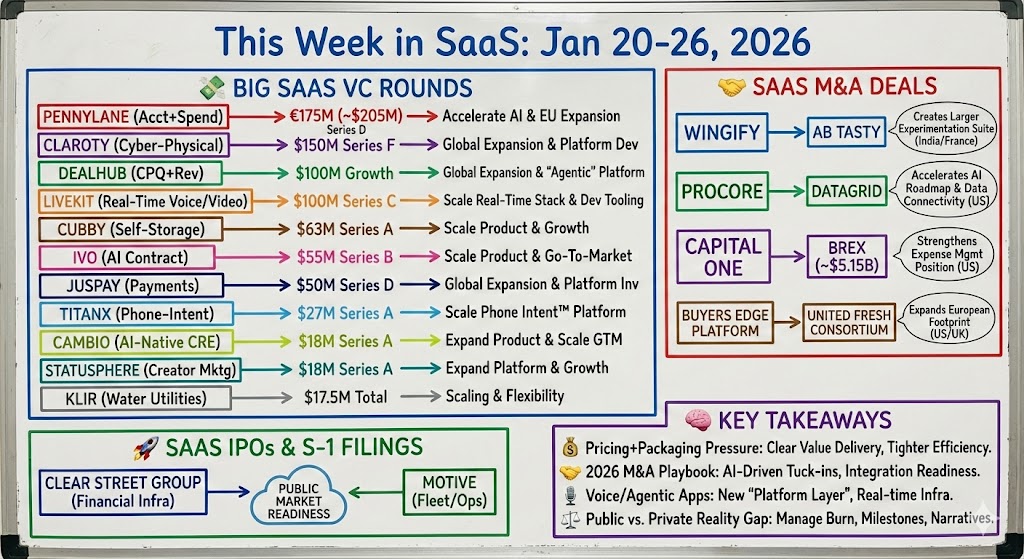

💸 Big SaaS VC Rounds

- Pennylane (accounting + spend management; SaaS) – raised a €175M (~$205M) Series D on Jan 20, 2026; funds will accelerate product investment (incl. AI) and European expansion.

- Claroty (cyber-physical systems protection; SaaS) – raised a $150M Series F on Jan 22, 2026; funds will support global expansion and platform development.

- DealHub (quote-to-revenue / CPQ + revenue orchestration; SaaS) – raised a $100M growth round on Jan 22, 2026; funds will accelerate global expansion and advance its “Agentic” quote-to-revenue platform.

- LiveKit (real-time voice/video infrastructure; SaaS) – raised a $100M Series C on Jan 22, 2026; funds will scale its real-time stack for voice-first/agentic apps and developer tooling.

- Cubby (self-storage property management + revenue tools; vertical SaaS) – raised a $63M Series A on Jan 22, 2026; funds will scale product and growth for self-storage operators.

- Ivo (AI contract intelligence; SaaS) – raised a $55M Series B on Jan 20, 2026; funds will scale product and go-to-market for in-house legal workflows.

- Juspay (payments infrastructure / orchestration; SaaS/API) – raised a $50M Series D follow-on on Jan 23, 2026; funds will support global expansion and platform investment.

- TitanX (phone-intent scoring for outbound sales; SaaS) – raised a $27M Series A on Jan 20, 2026; funds will scale its Phone Intent™ platform and growth.

- Cambio (AI-native CRE operations platform; SaaS) – raised a $18M Series A on Jan 22, 2026; funds will expand product capabilities and scale go-to-market.

- Statusphere (micro-influencer / creator marketing platform; SaaS) – raised a $18M Series A on Jan 20, 2026; funds will expand the platform (incl. social SEO/GEO) and growth.

- Klir (ops/compliance hub for water utilities; SaaS) – closed $17.5M total financing (a $10M Series B + $7.5M credit facility) on Jan 22, 2026; funds will support scaling and long-term balance-sheet flexibility.

🤝 SaaS M&A Deals

- Wingify completed the acquisition of AB Tasty (~$150M–$200M; digital experience optimization; SaaS; India/France) – announced on Jan 20, 2026; this acquisition creates a larger experimentation + personalization suite and expands global reach.

- Procore completed the acquisition of Datagrid (undisclosed; construction AI + data integration; vertical SaaS; US) – announced on Jan 20, 2026; this acquisition accelerates Procore’s AI roadmap and improves cross-system data connectivity for customers.

- Capital One completed the acquisition of Brex (~$5.15B; spend/expense management; fintech SaaS; US) – announced on Jan 22, 2026; this acquisition strengthens Capital One’s position in expense management and business payments workflows.

- Buyers Edge Platform completed the acquisition of United Fresh Consortium (undisclosed; foodservice procurement network + analytics; vertical SaaS-adjacent; US/UK) – announced on Jan 26, 2026; this acquisition expands Buyers Edge’s European footprint in fresh procurement programs.

🚀 SaaS IPOs & S-1 Filings

- Clear Street Group (cloud-native financial infrastructure; software/SaaS-adjacent; US) – filed an S-1 on Jan 20, 2026; this filing signals renewed public-market readiness for infrastructure-first platforms.

- Motive (fleet/operations management; SaaS; US) – S-1 activity recorded on Jan 20, 2026; this adds to the 2026 pipeline of enterprise-focused offerings.

🧠 Key Takeaways

- Pricing + packaging pressure is still real: seat-based growth is being questioned, and buyers are pushing for clearer value delivery—plan for packaging experiments and tighter efficiency metrics.

- 2026 M&A playbook: expect more AI-driven tuck-ins, sponsor liquidity pressure, and cross-border activity—founders should keep integration readiness and “why now” narratives crisp.

- Voice/agentic apps are becoming a new “platform layer”: shipping realtime/voice experiences requires new infra + observability—build with statefulness, testing, and deployment constraints in mind.

- Public vs. private reality gap: private AI-native B2B valuations and expectations may diverge sharply from public comps—operators should manage burn, milestones, and fundraising narratives accordingly.

📰 Community News

- Apply to join the SaasRise community for SaaS CEOs and Founders with $1M+ in ARR

- Apply to join the GrowthRise community for B2B Marketing Leaders

- Join Pulse, our AI-curated tech news reader, to see the latest SaaS, AI, and tech news and deals

See you next week with the next edition ofThis Week in SaaS.

-Ryan Allis, CEO of SaasRise